Contribution Margin Ratio Formula Per Unit Example Calculation

Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. Understanding how costs change with business activity and knowing which products contribute most to the bottom line are essential skills for modern managers. These courses dive into the economic forces shaping markets and teach practical skills for making smart business decisions.

Great! The Financial Professional Will Get Back To You Soon.

Do these labor-saving processes change the cost structure for the company? The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage. In order to perform this analysis, calculate the contribution margin per unit, then divide the fixed costs by this number and you will know how many units you have to sell to break even. The calculation of the contribution margin is instrumental in shaping pricing strategies. By knowing the exact contribution of each product to the overall profit, businesses can make informed decisions about pricing adjustments.

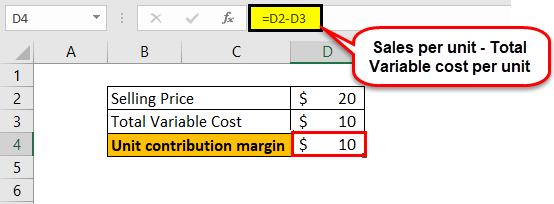

Contribution Margin Formula:

Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. Enter the selling price per unit, variable cost per unit, and the total number of units sold into the contribution margin calculator. The calculator will display the contribution margin amount and ratio in percentage. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000.

Costs to Include in Contribution Per Unit

Direct variable costs include direct material cost and direct labor cost. An important point to be noted here is that fixed costs are not considered while evaluating the contribution margin per unit. As a result, there will be a negative contribution to the contribution margin per unit from the fixed costs component. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit.

One common misconception pertains to the difference between the CM and the gross margin (GM). If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs.

Decisions can be taken regarding new product launch or to discontinue the production and sale of goods that are no longer profitable or has lost its importance in the market. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs). These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible.

- However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs).

- On the other hand, contribution margin refers to the difference between revenue and variable costs.

- If your fixed costs are $20,000, the generated profit would be $10,000 ($30,000 total contribution margin – $20,000 fixed costs).

- When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits.

- Input Price per Unit and Variable Cost per Unit, and our calculator will help you estimate Contribution Margin.

- Leave out the fixed costs (labor, electricity, machinery, utensils, etc).

The contribution margin (CM) is the amount of revenue in excess of variable costs. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage.

On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. However, an ideal contribution margin analysis will cover both fixed and variable cost and help the business calculate the breakeven. A high margin means the profit portion remaining in the business is more. It may turn out to be negative if the variable cost is more that the revenue can cover. Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit.

If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. With a high contribution margin ratio, a firm makes greater profits when sales increase and more losses when sales decrease compared to a firm schedule b form report of tax liability for semiweekly schedule depositors with a low ratio. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances.

These financial metrics provide essential insights that can significantly impact a company’s profitability. When a company is deciding on the price of selling a product, contribution margin is frequently used as a reference for analysis. Fixed costs are usually large – therefore, the contribution margin must be high to cover the costs of operating a business.

Contribution margin is a business’s sales revenue less its variable costs. The resulting contribution dollars can be used to cover fixed costs (such as rent), and once those are covered, any excess is considered earnings. Contribution margin (presented as a % or in absolute dollars) can be presented as the total amount, amount for each product line, amount per unit, or as a ratio or percentage of net sales. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit.