Fully Diluted EPS Definition, Calculations, Types, Limitations

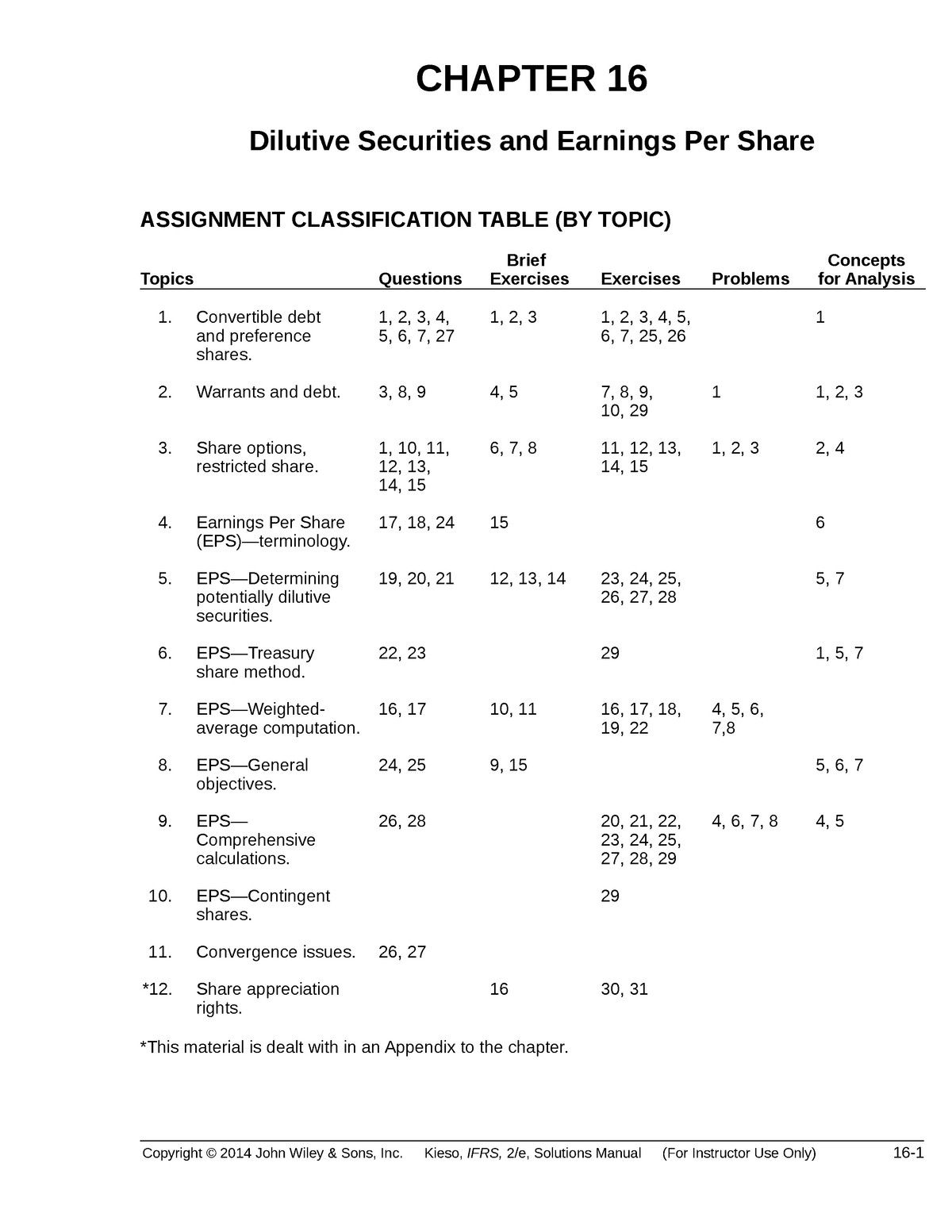

For this reason, many public companies publish estimates of both non-diluted and diluted EPS, which is essentially a “what-if-scenario” for investors in the case new shares are issued. Diluted EPS assumes that potentially dilutive securities have already been converted to outstanding shares. This method is used when there is no additional form of payment to the company and is generally applied to preferred stock and convertible debt. When a preferred stock or convertible debt is converted, it increases the number of common shares outstanding. In addition, the preferred dividends and interest payments are no longer required as they have been converted to common stock and are added back on a tax-effected basis.

- Cara belajar hacking untuk pemula

- Cara deface website untuk pemula

- Cara menjadi ethical hacking

- Cara menjadi pentester

- Cara belajar hack website untuk pemula

Get in Touch With a Financial Advisor

We add the $50,000 to net income assuming that the conversion will occur at the beginning of the period, so it would not pay out dividends. If the company is issuing new stock as a means to boost revenue, then it may be positive. It may also be doing so to raise money for a new venture, whether that’s investing in a new product, a strategic partnership, or buying out a competitor. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. So, you will still get your piece of the cake only that it will be a smaller proportion of the total than you had been expecting, which is often not desired.

Additional Resources

For example, MGT Capital filed a proxy statement on July 8, 2016, that outlined a stock option plan for the newly appointed CEO, John McAfee. Additionally, the statement disseminated the structure of recent company acquisitions, purchased with a combination of cash and stock. Public companies must report EPS on their income statement and include both primary and diluted EPS. A basic EPS equals the company’s net income minus preferred dividends, divided by the weighted- average of outstanding common shares.

Related Stocks

Rather, most dilutive securities provide a mechanism through which the owner of the security can obtain additional common stock. If triggering the mechanism results in a decreased EPS for existing shareholders—by increasing the total amount of outstanding shares—then the instrument is said to be a dilutive security. Some examples of dilutive securities include convertible preferred stock, convertible debt instruments, warrants, and stock options. The if-converted method is used to calculate diluted EPS if a company has potentially dilutive preferred stock. To use it, subtract preferred dividend payments from net income in the numerator and add the number of new common shares that would be issued if converted to the weighted average number of shares outstanding in the denominator.

It is not adjusted for stock equivalents (such as options, warrants, and convertible securities). Normally, existing shareholders do not favor the dilution of shares or equity; hence, sometimes, companies take initiatives, such as share repurchase programs, to limit dilution. Stock dilution should not be confused with stock splits, which neither decrease nor increase dilution. When a company enacts stock splits, current shareholders receive extra shares without any effect on their ownership percentage in the company. Diluted shares are most commonly used to calculate a company’s earnings per share (EPS).

- Cara belajar hacking untuk pemula

- Cara deface website untuk pemula

- Cara menjadi ethical hacking

- Cara menjadi pentester

- Cara belajar hack website untuk pemula

- Anti-dilution provisions are clauses in securities contracts that protect investors from dilution.

- That’s why many investors get attracted to the conversion feature of diluted securities and buy them.

- A high diluted EPS with a lower difference than the basic EPS means there is less chance of dilution.

- There also several financial ratios like the dilutive earnings per share that track the effect of these securities.

- Stock equivalents potentially dilute eps when they provide a mechanism by which net income may be distributed to shareholders in the form of dividends or share repurchases.

Ask a Financial Professional Any Question

There also several financial ratios like the dilutive earnings per share that track the effect of these securities. Although news of a secondary offering is typically not welcomed by shareholders because of dilution, an offering can inject the company with the capital necessary to restructure, pay down debt, or invest in research and development. In the end, acquiring capital through a secondary offering can be a longer-term positive for the investor, if the company becomes more profitable and the stock price rises. Fully diluted EPS is an essential financial metric for investors as it provides a more accurate representation of a company’s earnings per share. It is important to compare the fully diluted EPS of companies in the same industry to assess their financial health and performance. After-tax interest on the convertible debt is added to the net income in the numerator and the new common shares that would be issued at the conversion are added to the denominator.

There are various types of securities that could impact the fully diluted EPS calculation. The most common types of securities include stock options, warrants, convertible preferred stocks, convertible bonds, and anti-dilution provisions. Dilution can be caused due to a number of dilutive securities such as stock options, restricted and performance stock units, is the first preferred stock, warrants, and convertible debt. Dilution may cause the share price to decline because it reduces the company’s earnings per share (EPS). While it primarily affects equity ownership positions, dilution also reduces the company’s earnings per share (EPS, or net income divided by the float), which often depresses stock prices in the market.

- Cara belajar hacking untuk pemula

- Cara deface website untuk pemula

- Cara menjadi ethical hacking

- Cara menjadi pentester

- Cara belajar hack website untuk pemula

For a financial analyst, it is important to have a solid understanding of the difference between basic and fully diluted shares and what it means for key metrics including EPS. It is relatively simple to analyze diluted EPS as it is presented in financial statements. Companies report key line items that can be used to analyze the effects of dilution. These line items are basic EPS, diluted EPS, weighted average shares outstanding, and diluted weighted average shares. Many companies also report basic EPS excluding extraordinary items, basic EPS including extraordinary items, dilution adjustment, diluted EPS excluding extraordinary items, and diluted EPS including extraordinary items. The corporation’s stock that has been approved and issued is known as the outstanding shares.

Rights to purchase stock are similar to options in that they give the owner of the right the authority to purchase new common stock. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

- Cara belajar hacking untuk pemula

- Cara deface website untuk pemula

- Cara menjadi ethical hacking

- Cara menjadi pentester

- Cara belajar hack website untuk pemula

Common stock is obviously the most common dilutive security because any additional issuances of common stock will automatically raise the number of outstanding shares. The concept of dilutive securities can be more theoretical than actual, since these instruments will not be converted into common stock unless the price at which they can be purchased will generate a profit. In many cases, the strike prices are set above the market price, so they will not be exercised. Since the securities are converted into additional shares at a price less than the market price of the company’s shares, fewer shares can be repurchased from the proceeds of the conversion. If converted, dilutive securities effectively increase the weighted number of outstanding shares, decreasing EPS, and thereby devaluing a shareholder’s existing equity stake. Forward-looking statements are neither historical facts nor assurances of future performance.